States Enact Natural Gas Vehicle and Infrastructure Incentives

During the first part of 2013, several states enacted legislation pertaining to natural gas vehicles (NGVs) and natural gas infrastructure development.

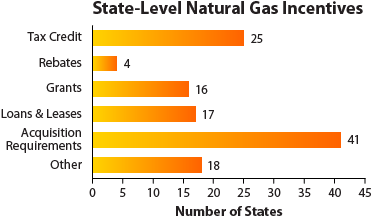

In recent years, as deployment of natural gas fueling infrastructure has increased and natural gas prices have remained attractive compared to conventional fuels, NGVs have grown in popularity. State incentives have helped to increase the acceptance of the fuel and vehicles, and recent state-level activity reflects the growing appeal and desire to foster expanded deployment. The figure on the right shows the number of states in which various types of natural gas incentives and laws are in place.

Tax credits continue to be a common incentive in the alternative fuels industry, enabling taxpayers to subtract all or part of the incremental cost of vehicles, conversions, and fueling equipment from their tax liability.

Rebates and vouchers are examples of more direct financial incentives for vehicle and infrastructure owners. These incentives function like a refund or "coupon" for all or a portion of the incremental cost of a vehicle or infrastructure purchase. Both have gained popularity among state legislatures looking to encourage vehicle and infrastructure deployment. Recent examples include:

- Florida's NGV rebates that cover as much as 50% of the incremental cost of a new vehicle or vehicle conversion, up to $25,000 per vehicle and $250,000 annually per applicant. Note that this incentive applies to propane vehicles as well.

- Maryland's NGV vouchers for the purchase of new and converted NGVs, up to $20,000.

- Arkansas' vehicle and infrastructure rebates for 50% of the incremental cost of a new vehicle or conversion, up to $4,500. Note that this incentive also applies to propane vehicles and infrastructure.

Through grants, the government provides financial assistance for NGV purchases, research and development projects, or other related activities. For example, the Pennsylvania legislature introduced a program in 2012 for municipal and commercial fleet vehicle grants, covering 50% of the incremental or conversion cost, up to $25,000 per vehicle.

State and local government fleets should also consider pilot programs. These can provide a perfect opportunity to study vehicle use and performance, develop fueling infrastructure, and spur public interest through increased exposure and familiarity with the technology. In 2013, Arkansas enacted a natural gas school bus grant and loan pilot program to help four public school districts purchase 10 buses.

Although technically categorized as laws or regulations as opposed to incentives, acquisition requirements can achieve results akin to those of pilot programs by increasing vehicle deployment among government fleets and facilitating public exposure of the technology. Many states have enacted general alternative fuel vehicle acquisition requirements, but Wyoming took the added step of implementing an NGV-specific requirement in February 2013. This provision requires certain Wyoming state agencies to ensure at least 50% of their vehicle acquisitions through June 30, 2017, are dedicated or bi-fuel NGVs (provided an appropriate NGV model is commercially available and the vehicle will be stationed in a municipality with existing or planned fueling infrastructure).

States also use fuel taxes to incentivize the use of natural gas, like exempting NGV owners from paying fuel taxes or offering an annual tax decal in lieu of paying tax on a volumetric basis. In 2013, Florida joined the list of states providing fuel tax incentives by eliminating fuel taxes through January 1, 2019, and establishing a natural gas and propane tax that is structured differently from that of conventional fuel sales.